IMF puts countries into debt, poverty & inequality but who in Sri Lanka wants IMF – why?

When Sri Lanka’s top corporates have stashed away some $53billion in overseas accounts, it is because they are cheating the country, they don’t want to invest in Sri Lanka or they are as corrupt as the politicians. Whatever, the reason, their collective silence in not coming forward to bail out Sri Lanka & fully aware that the ordinary people & middle class will suffer, shows moral decline of Sri Lanka’s corporate community. These handful of Sri Lankan corporates could have easily come up with a plan to present to the public on how Sri Lanka could move forward with their investment without falling subject to more IMF loans. In understanding what the IMF imposes for loans given, whom these conditions apply & affect, the eventual outcomes like poverty, inequality, debt & depression – people should ask the Sri Lankans promoting going to IMF, why they are so gaga over it!

- Conditionality in IMF Loans – loans are given with conditions though countries have to pay back loan with interest. These conditions are often intrusive & interfere in the internal affairs of countries. All conditions target only lower-classes & middle classes as a result of forcing governments to reduce spending on social welfare, increase taxes, increase prices of essential goods, increase interest rates, facilitate firms to go bankrupt, wage cuts/freezes, pension reforms, military cuts, force state entities to be privatized. These making already ailing countries fall further into disarray & increase poverty, unemployment, depression & social unrest. All of these IMF conditions have domino effect.

- IMF exchange rate reforms have often led to removing controls that facilitated corrupt politicians & corporates to transfer money out of the country (Goldenberg scandal)

- IMF allows inflationary devaluations.

- IMF insists on neo-liberal policies like blanket privatization that creates private monopolies who exploit consumers without controls. Unit in the Ministry of Finance set with task of “restructuring” (privatizing) 420 state-owned enterprises under GoSL especially 55 strategic SOEs that employ around 1.9% local labor.

- IMF bail outs often lead to corrupt governments not planning but agreeing to IMF conditions to take more loans. The cycle of debt continues & IMF is happy because its neo-liberal policies can continue while also getting countries to fork out interest.

- IMF also stands guilty of keeping policy & decisions secret from public domain & among select politicians who are happy to endorse IMF conditions & policies.

- IMF short-term solutions often lead to long-term problems for countries who have to deal with rising poverty, social unrest & failing economy.

- One of the core reasons for countries to go to IMF is its low interest, but what countries & people who promote going to IMF does not factor in is the conditions that result in long-term crisis for countries. Such crisis enables IMF to re-enter with fresh loans, more conditions and this cycle continues which works well for IMF who is part of the neo-liberal capitalist apparatus involving in securing national resources/assets under corporate control.

Successive Govts accused of corruption have however fallen naively victim to seeking advice from international advisors as well as local bodies that are funded from overseas, who peddle the privatization option & neo-liberal ideologies & the corrupt status of governments are used to cunningly draw them to agree to policy changes that fulfil the wish lists of these globalists.

Verite Research & Centre for Policy Alternatives are two other NGOs/Civil Society players who were at the call to default on debt payment alongside. https://island.lk/chinas-stand-may-deprive-sri-lanka-of-usd-2-9-bn-from-imf-in-early-2023/

Paikiasothy Saravanamuttu … “China’s unwillingness to accept the proposed debt restructuring might deprive Sri Lanka of the US$ 2.9 billion credit facility, from the IMF”

The main opposition Samagi Jana Balawega too have been mooting for IMF bailout, while JVP leader Anura Dissanayake claimed there was no other alternative & party stalwart Sunil Handunetti claimed that the government was not going to IMF because of corruption.

http://bizenglish.adaderana.lk/jaaf-welcomes-progress-in-securing-imf-fund-facility/

The Joint Apparel Association Forum (JAAF) welcomes… the long-awaited USD 2.9 billion bailout package. JAAF says it is “imperative that the country makes progress on other reforms required to get the country back on a growth agenda. These include reforms of the State-Owned Enterprises, labour law reform and pursuing Free Trade Agreements with countries like Australia, Japan, Korea and Canada which have enormous potential”

“We are now in sight of the ‘IMF agreement approval’ and with it more positive economic sentiments like more FDI and better credit facilities will come Sri Lanka’s way/ If you take these positive factors into consideration Sri Lanka may be the first country in the world to have recovered from an economic crisis in such a short time”, Duminda Hulangamuwa, the Vice Chairman of the Ceylon Chamber of Commerce and a Senior Partner and the Head of Tax at Ernst & Young

https://www.facebook.com/watch/?v=1327176164728089

Development Economist Professor Jayati Ghosh and Economist and Social Scientist Dr. Howard Nicolas believe that the path Sri Lanka chose for economic recovery with the support of the IMF would hurt the island’s poor and marginalised segments and they believed that debt forgiveness would be the only solution for Sri Lanka’s recovery.

So while the political opposition, key corporates & civil society are claiming IMF is the only solution, economists Jayati Ghosh & Dr. Howard Nicolas eloquently argue why IMF is not the solution. This is further backed by OXFAM report says 80% of covid-19 loans given by IMF have pushed nations to poverty.

However, ADVOCATA Chair Murtaza Jafferjee claims Sri Lanka would lose access to international creditor markets as soon as it resolves to debt forgiveness while also causing a collapse in the country’s banking system. We can see who is right in time to come. ADVOCATA is linked to Mont Pelerin Society & Atlas Network. ADVOCATA stalwarts not only promote IMF bail outs but campaign to privatize SOEs. Everyone’s easy solution is sell one’s silver. Thereafter, what happens is not their concern.

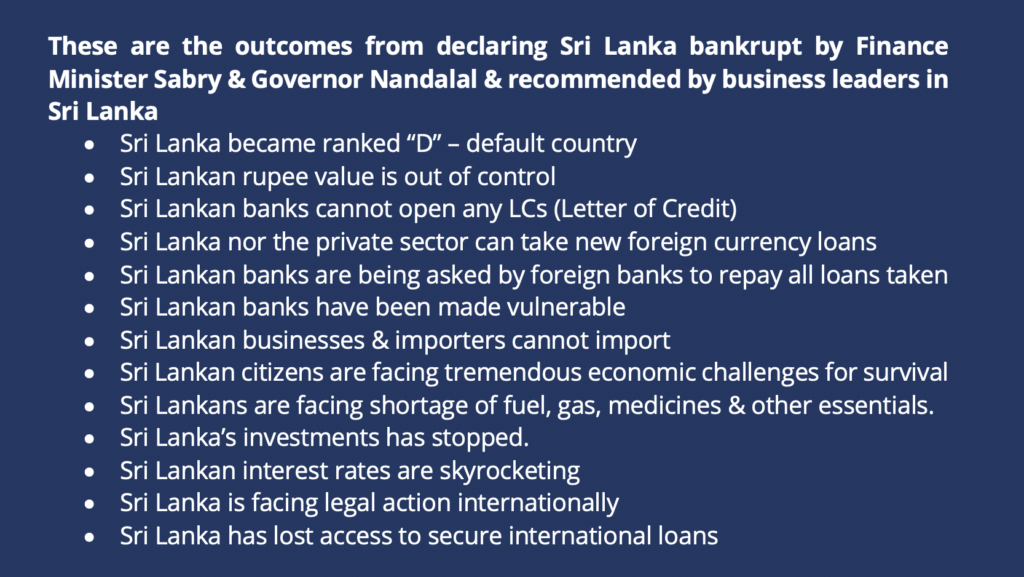

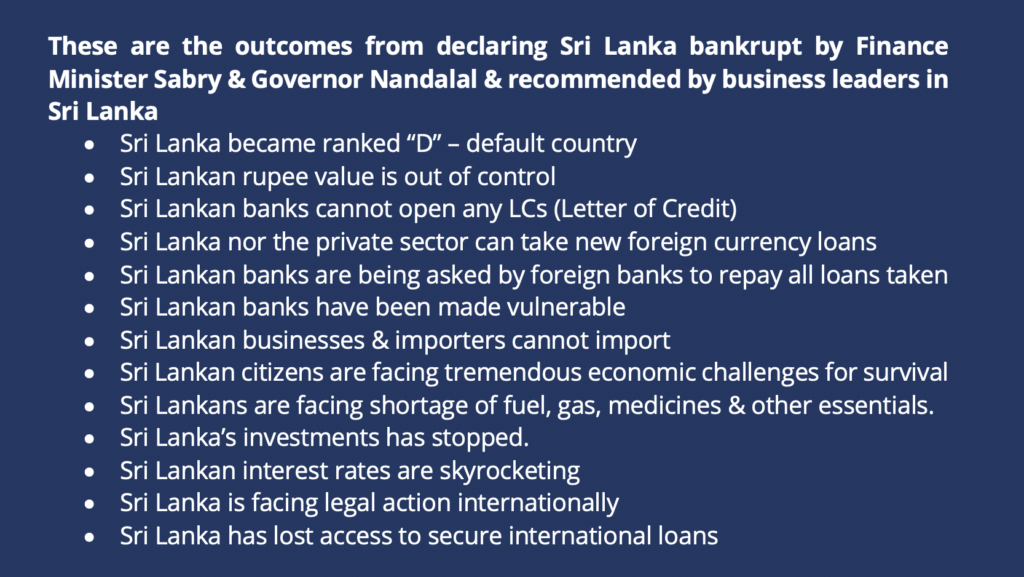

When Sri Lanka’s then Finance Minister & present Foreign Minister Sabry announced default on debt repayment, this was the outcome.

Yet it was not only politicians & CBSL that mooted default on repayment, Sri Lanka’s top businessmen, think tanks & economists called for the same.

It is no wonder Sri Lanka is in this abysmal state – we cannot rely not only on the politicians but even the corporates & the think tanks that are heavily reliant on foreign funding. Making matters worse is that the majority of these companies that mooted debt default, had made use of the 2017 Foreign Exchange Control Act to deposit their profits overseas. We have to wonder how many of these companies have been indirectly responsible for the economic collapse as well as question why they are promoting IMF $2.9b bailout with austerity for the poor & middle class, when they could have easily come to an arrangement with the GoSL & brought this $2.9b of their $53b back to Sri Lanka.

Shenali D Waduge